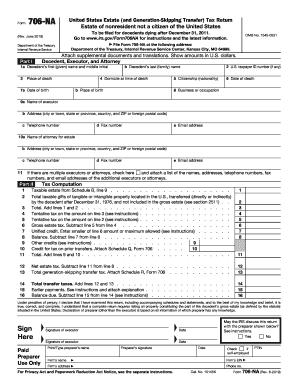

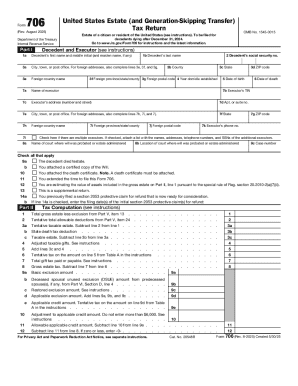

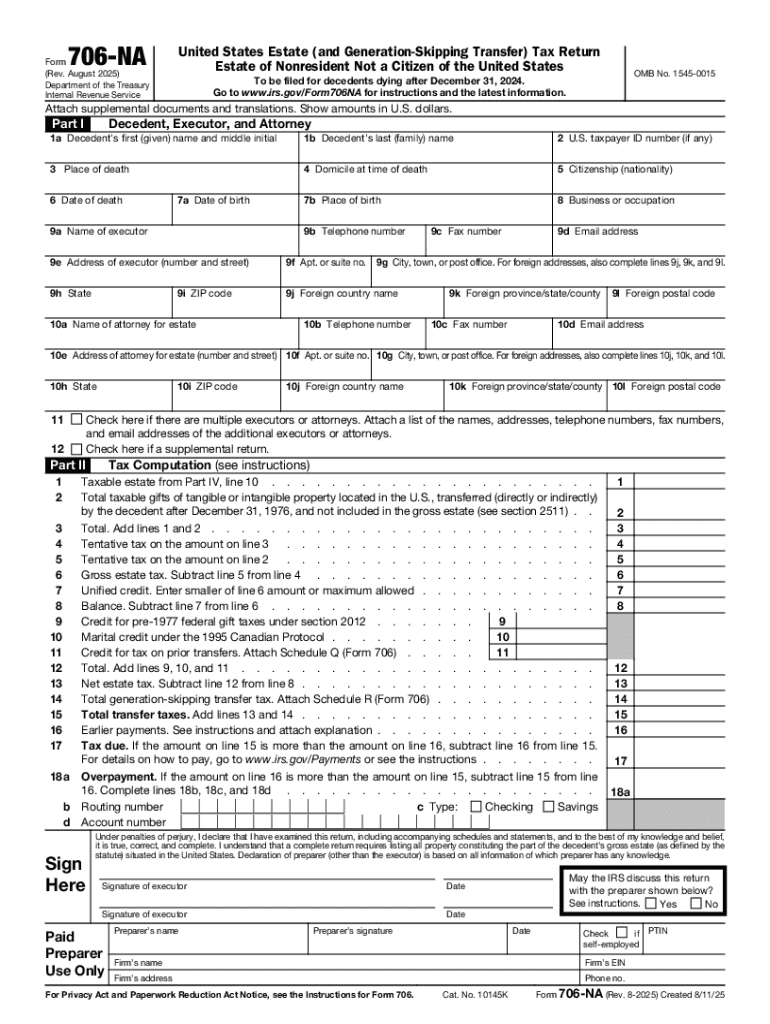

IRS 706-NA 2025-2026 free printable template

Instructions and Help about IRS 706-NA

How to edit IRS 706-NA

How to fill out IRS 706-NA

Latest updates to IRS 706-NA

All You Need to Know About IRS 706-NA

What is IRS 706-NA?

When am I exempt from filling out this form?

Due date

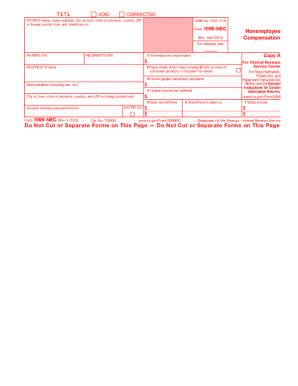

What payments and purchases are reported?

What are the penalties for not issuing the form?

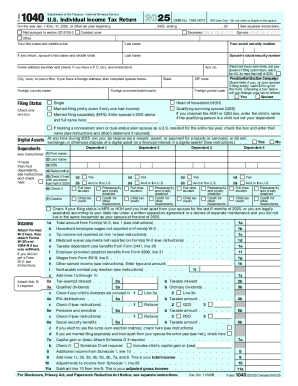

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 706-NA

What should I do if I notice a mistake after filing my IRS 706-NA?

If you discover an error in your IRS 706-NA after submission, you can file an amended return to correct those mistakes. Be sure to clearly indicate on the form that it is an amendment and attach a detailed explanation of the changes. This ensures proper handling by the IRS.

How can I track the status of my IRS 706-NA submission?

To verify the receipt and processing status of your IRS 706-NA, you can check the IRS website or call their helpline. Keep your submission confirmation handy, as it may be needed to resolve issues if your submission is rejected or delayed.

What technical requirements should I meet for e-filing the IRS 706-NA?

When e-filing your IRS 706-NA, ensure you are using compatible software as specified by the IRS. Also, using current web browsers and maintaining stable internet access will help ensure a smooth submission process. Always check for updates from your e-filing service provider.

What are common mistakes people make when filing the IRS 706-NA?

Common errors include miscalculating values, failing to sign the form, or not submitting required supporting documents. To avoid these pitfalls, carefully review each section and consider consulting with a tax professional before filing the IRS 706-NA.

How does IRS handle requests for a power of attorney for IRS 706-NA filings?

If you need to file the IRS 706-NA on behalf of someone else, you must submit a power of attorney (POA) along with the form. Ensure that the POA is completed correctly to allow the IRS to recognize your authority to act for the taxpayer.